In Berry v. Queen the Maryland Court of Appeals held that the cost of getting a rental car must be covered under the uninsured motorist component of auto insurance policies. This is a significant decision that will impact any Maryland drivers who get in an accident with an uninsured driver. For the first time, we have a clear ruling that uninsured motorist coverage requires the insurance company to provide a rental car.

What Were the Facts in Berry v. Queen?

This was actually two cases involving the same issue that were consolidated for purposes of the opinion on appeal. The underlying facts of the cases had no real impact on the court’s analysis or decision, but they are worth a brief overview. They both involve State Farm. We have had to battle State Farm many times to get our clients’ a rental car. So it is fitting these are State Farm cases.

Case 1

In the first case, Misc. No. 10., a man in St. Mary’s County had an auto insurance policy with State Farm that did not include the optional rental car coverage. He was struck by a driver with no insurance and had to get a rental car while his vehicle was being repaired.

He submitted a $300 claim for the cost of the rental to State Farm under the property damage section of his UIM coverage. State Farm denied that claim which led the insured to file a class action suit in Circuit Court.

State Farm removed the case to federal court and filed a motion to dismiss. The U.S. District Court for the District of Maryland denied the motion to dismiss and then submitted a certified question of state law to the Maryland Court of Appeals.

Case 2

The second case, Misc. No. 63, also involved a UIM claim with State Farm. In this case, however, State Farm paid for 80% of the insured’s rental car expense. State Farm refused to pay for the remaining 20% and the insured filed a complaint with the Maryland Insurance Administration (“MIA”). The MIA held an administrative hearing and concluded that State Farm’s refusal to pay the 20% was in violation of Md. Code Ann., Ins. §§ 4-113 and 27-303(2).

State Farm appealed for a judicial review of this decision. The Circuit Court for Baltimore City overruled the MIA administrative decision and held in favor of State Farm. The MIA appealed and the Court of Appeals reached down and granted certiorari while the case was still pending in the COSA.

The Court’s Holding and Reasoning

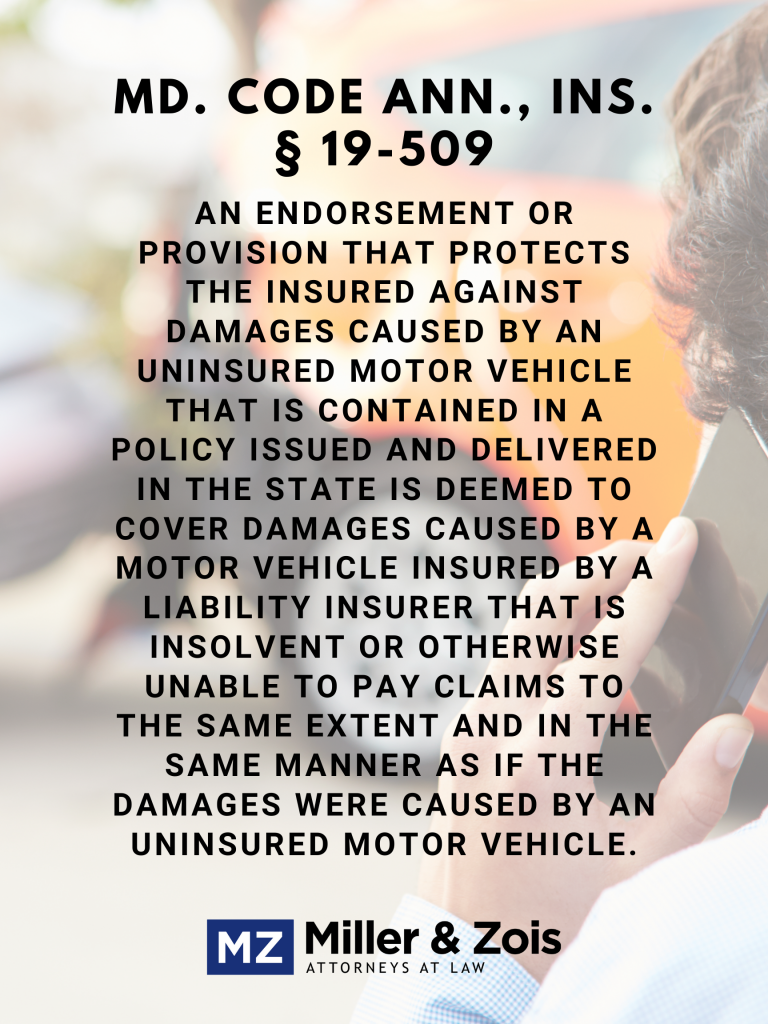

The legal issue presented to the court was clear and straightforward. Maryland has an Uninsured Motorist Statute Md. Code Ann., Ins. § 19-509 (the “UIM Statute”) that requires all auto insurance policies to provide coverage for damages caused by uninsured drivers. The question for the Court was whether the UIM Statute required insurance companies to provide UIM coverage for loss of use damages (i.e., rental car expenses).

State Farm argued that the language of the UIM Statute does not require coverage for loss of use simply because the terms “loss of use” or “rental car coverage” are not specifically found in the language of the statute.

In State Farm’s view, those terms must explicitly appear in the UIM Statute in order for rental car coverage to be required.

Counsel for MIA argued that the UIM Statute refers to “damage to property” and that term includes loss of use damages. They argued that this interpretation was support by case law and the UIM Statute’s underlying purpose.

What does damage to property mean?

The Court’s holding relied entirely on its interpretation of the phrase “damage to property” in the UIM Statute.

First, the Court referenced the dictionary definitions of the words “damage” and “property.” Based on this analysis, the Court concluded that the phrase “damage to property” means that “the lawful owner is deprived of the ability to apply the object in a manner that he or she desires[.]”

Next, the court went on to look at some early case law illuminating the types of damages encompassed by the term “damage to property.” The court discussed 2 cases in particular: Washington Baltimore & Annapolis Electric Railway Co. v. William A. Fingles, Inc., 135 Md. 574 (1920) and Taylor v. King, 241 Md. 50 (1965).

In Fingles, the term “damage to property” was held to include both the cost or repairing the property and the “value of the use of the property during the time it would take to repair.” In the Taylor case, damage to property in an auto accident context was held to include “a reasonable allowance for loss of use of the vehicle.”

Finally, the court also relied on its decision in D’Ambrogi v. Unsatisfied Claim & Judgment Fund, 269 Md. 198 (1973). In D’Ambrogi, the court held that loss of use damages were covered under the predecessor to Maryland’s current UIM Statute.

Based on these prior cases, as well as the general intent and purpose behind the UIM Statute, the court held that the phrase “damage to property” in the UIM Statute includes loss of use damages.

Under this holding, UIM coverage must fully cover rental car expenses even if they are not otherwise covered under the general insurance section of the policy. Applying this ruling to the underlying cases, the Maryland high court concluded that State Farm was obligated to cover the rental car expenses.

What Berry v. Queen Means for Accident Victims?

Not surprisingly, I enthusiastically agree with the court’s decision in this case. This decision is a well-deserved victory for the rights of Maryland drivers.

The whole idea behind uninsured motorist coverage is to protect good, responsible drivers who pay for insurance like they are supposed to. This decision from the Court of Appeals helps to further that goal by making sure UIM covers rental car expenses.

Does Uninsured Motorist Cover a Rental Car in Other Jurisdictions?

Every state’s law is different. Maryland in its uninsured motorist statutory scheme is aggressive in providing coverage for victims.

Maryland Injury Law Center

Maryland Injury Law Center