Click to enlarge

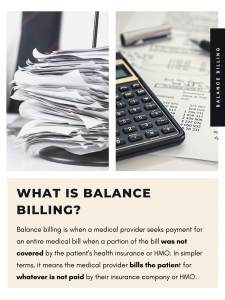

Dealing with healthcare providers who seek to “balance bill” in personal injury cases is becoming an increasingly frequent occurrence in our practice. Balance billing is when the medical provider seeks payment for the entire bill, when the patient’s health insurance or HMO does not cover that portion of the bill. The medical provider bills the patient for whatever the insurance company or HMO does not pay.

Maryland Balance Billing Law

Balance billing in Maryland is permissible if it is not limited by law or contract. But when medical providers agree to accept reimbursement from government health plans, there are often restrictions on the ability of the medical provider to balance bill. With private medical insurance like most of us have, the insurance company often mandates by contract to protect their insureds by requiring the provider accepting the insurance to accept the insurance company’s payment along with any necessary Co-pays.

For example, your client’s insurance company might pay $4,000 for a particular surgery, but the surgeon charges $5,000. If the surgeon’s office accepts the plan’s payment but then seeks to collect the remaining balance from the client, the surgeon is balance billing the client. The question for the personal injury lawyer who is trying to get as much money as he/she can for their client is can medical providers balance bill from a settlement or judgment of a personal injury claim?

If the provider is Medicare, the answer is no. See 42 U.S.C. 1395(y). In Maryland, medical providers cannot balance bill if an HMO makes payments. See Health General Section 19-710(o); Patel v. Healthplus, Inc., 112 Md. App. 251 (1996).

Regarding other insurance companies, the answer is the provider cannot balance bill. But it depends on the insurance company’s contract with the medical provider. In-network medical providers may not balance bill for covered services under the terms of their contract.

They must accept the amount paid by the plan (plus any member Co-payment and/or coinsurance) as stipulated in their contract. The language of the contract will provide the answer. Medical providers that are out-of-network and do not have an agreement with the insurance company, often hospitals after an emergency room visit, may balance bill.

If you are in an HMO or PPO, the law might protect you beyond your co-pays and deductible, but contracting and non-contracting providers may directly bill an HMO member for a non-covered service. Doctors who accept assignments also may not balance bill in Maryland.

In Maryland, CareFirst Blue Cross Blue Shield provides insurance for many of us. Ultimately, the doctor’s ability to balance the bill will depend on the specifics of the doctor’s contract with CareFirst. We have not seen every provider’s contract but it can also depend on whether the health care provider is in or out of the network. CareFirst is sometimes helpful with these issues if you do not mind spending time on hold.

Balance Billing and Workers’ Comp in Maryland

In workers’ compensation claims, balance billing is generally not allowed. Healthcare providers are required to accept the payment made by the workers’ compensation insurance carrier as payment in full for the services provided. This means that the healthcare provider cannot bill the injured worker for any amount beyond what the insurance carrier has agreed to pay.

Additionally, many states have laws that specifically prohibit balance billing in workers’ compensation claims. For example, in Maryland, balance billing is not allowed in by statute for workers’ compensation claims. See MD. Code Ann., Labor & Employment §9-731(a)(ii).

Dealing with Health Care Providers That Are Balance Billing Your Clients

Four practice pointers for personal injury lawyers:

Continue reading